A new era of “data-driven taxation” is sweeping across industries at an unprecedented speed, ushering in a comprehensive new cycle of fiscal and tax digitalization.

This shift represents a transformation from experience-based decision-making to intelligent, big data-driven decision-making. Increasingly, businesses are realizing that traditional supply chain management models urgently require innovation.

As one of the leading retail enterprises in China, a prominent department store group is actively exploring innovative pathways for its supply chain.

To enhance financial management efficiency and improve supply chain collaboration, the company has introduced advanced digital technologies and tools to build an integrated financial supply chain platform. This platform enables real-time monitoring and collaborative management of cash flow, logistics, and information flow.

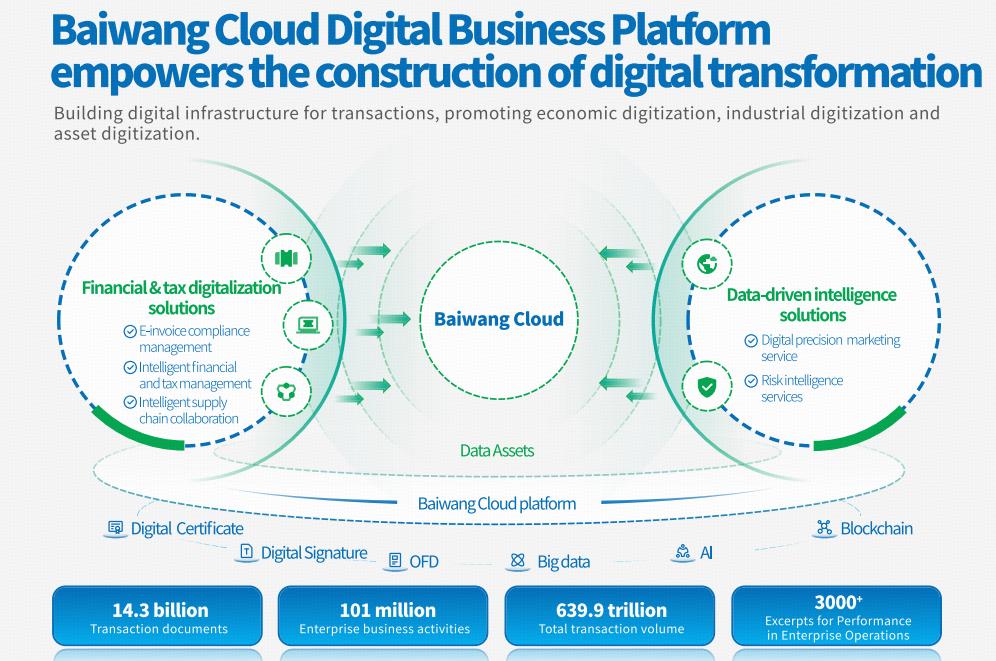

Baiwang Co (06657.HK)(abbreviated as Baiwang Cloud) ,is a leading provider of integrated financial and tax solutions in China. With the mission of “Linking Businesses,Simplifying Transactions”, Baiwang Cloud is committed to driving business innovation through data.

Baiwang Cloud has tackled the core pain points in its supply chain management, helping the company address bottlenecks in the collaboration process from the source.

1.Settlements Collaboration to Reduce Costs: From Passive Compliance to Proactive Efficiency

Baiwang Cloud helped the company achieve automation in accounts payable management, meeting the needs of both core enterprises and suppliers to generate settlement data online, reconcile accounts online, handle disputes online, and enable online invoicing by suppliers. This shift enables the automation of settlement, reconciliation, and invoicing, ensuring the seamless flow, matching, dispute resolution, and confirmation of core financial documents between the core enterprise and its suppliers. The result is a significant improvement in accounts payable automation, cutting reconciliation and invoicing processing costs by more than 80%.

2.Invoice Processing Cost Reduction: Powerful Matching Engine

Through Baiwang Cloud’s digital financial supply chain solution, the company has automated the processes of obtaining, recognizing, and verifying invoices online. Invoices are automatically matched with settlement data, and the system generates matching relationships for the three critical documents (purchase order, invoice, and receipt). This automation generates accounts payable vouchers and notifies suppliers of errors in invoices, significantly reducing the workload of accounts payable personnel by over 85%.

3.Risk Control and Compliance: Precise Supplier Risk Management

By leveraging supplier invoices and tax data (with authorized access in both the entry and collaboration scenarios), Baiwang Cloud provides 360-degree risk management for suppliers. Combining its powerful tax and financial risk models with external data sources such as industrial and commercial registration, judicial records, and tax authority blacklists, Baiwang Cloud enables comprehensive identification of tax, operational, and absconding risks. This helps businesses respond proactively to mitigate joint liabilities, improving risk identification rates by up to 95%.

4.Financial Gains: Supply Chain Finance Services

Baiwang Cloud integrates with over 110 financial institutions through its invoice and tax risk models, offering a wide range of supply chain finance products. Compared to traditional factoring services, these products do not occupy core enterprises’ credit limits, do not require guarantees from core enterprises, and offer same-day loan disbursement upon online application. This model effectively supports financial services for small and medium-sized suppliers and customers. Baiwang Cloud also provides free access to a “loan marketplace” and assists with loan facilitation, sharing bank commissions with core enterprises, and building a multi-party win-win ecosystem among suppliers, customers, core enterprises, platforms, and financial institutions.

5.Data Security, Integrity, and Availability

Baiwang Cloud’s digital financial supply chain solution ensures the security of data generation, storage, and transmission through robust mechanisms, guaranteeing the confidentiality, integrity, and availability of data. It also includes comprehensive backup and data recovery systems to safeguard enterprise data.

Baiwang Cloud enables enterprises to participate more rapidly in supply chain optimization, flexibly adapt to market competition, and support more effective business decision-making. It truly helps businesses achieve significant cost reduction and efficiency improvements, facilitating the digital transformation and upgrade of enterprises, bridging the gap between traditional models and a digital future.