Cushman & Wakefield’s New Report Reveals Growing Positive Trends Underpinned by Policy Optimization

Shenzhen, March 26, 2025 — Global real estate services firm Cushman & Wakefield has released its China Residential Market Report 2024, giving an overview of the Chinese mainland residential property market performance in 2024 and the market outlook for 2025.

The new report shows that China’s economy sustained a 5% y-o-y growth rate in 2024, although with the caveat that the macro-economic environment remains under substantial pressure. As one of the major pillars of the domestic economy, the real estate industry has dragged down overall economic growth for several years. The residential market, representing the largest segment of the overall real estate sector, has exerted the most significant influence on investment growth.

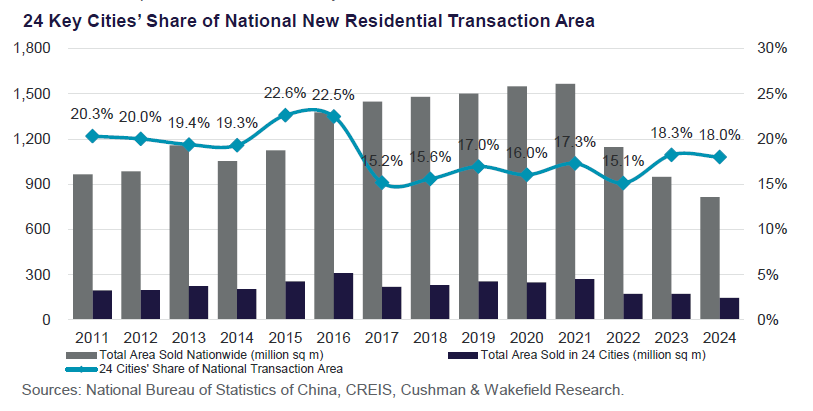

Key Cities’ Share of Total Transactions Expands as Transaction Hotspot Returns

The sales area of newly constructed residential units in the 24 key cities group in the report accounted for 18.0% of the national total for the full year 2024, increasing 2.4 percentage points from the January to September period. The upward trajectory of the key cities’ share of transaction area throughout the year indicates a more pronounced recovery in housing demand in Tier 1 and Tier 2 cities.

In 2015 and 2016, Tier 1 and Tier 2 key cities initiated a property market upsurge, with residential transaction areas in the 24 key cities then peaking at more than 22 of the national total. As the upsurge then extended beyond the key cities, their share of total residential transaction area declined. However, in the past two years, this share has risen again, demonstrating that the national residential transaction hotspot has returned to the key cities.

Some Housing Markets Rebuild Confidence Under Favorable Policies

On a month-on-month basis, the number of cities in the 70 Large and Medium-Sized Cities group tracked by Cushman & Wakefield experiencing sales price growth expanded in Q4 2024. The newly constructed housing market index recorded 23 cities with price growth in December, and the secondary-housing market index recorded nine cities.

The effect of the property market promotion policy released in September was significant, stimulating the release of upgrade and first-time buyer demand. In turn, market transaction areas expanded and supported a steady recovery in prices. The active performance of the newly constructed and secondary-housing markets reflected improved household confidence. In some markets landlords have increased selling asking prices. The recovery of residential market transaction areas plays a pivotal role in sustaining overall property prices.

Xiaoduan Zhang, Head of Research, South & Central China, Cushman & Wakefield, said, “We project that property market policies will maintain an accommodative stance in 2025, with room for further relaxation of restrictive measures in some cities, while loan interest rates may also adjust downwards. Meanwhile, proactive debt resolution measures will help mitigate systemic risks, while government purchases of existing home units are expected to both help accelerate affordable housing supply and to reduce inventory. Urban village monetized resettlement is also likely to stimulate demand.”

Jialong Cheng, Vice President, Greater China and Managing Director, South & Central China, Cushman & Wakefield, added, “The three consecutive years of downwards-trending residential development investment will impact future supply of new residential units, which in turn will affect the overall residential transaction area. In key cities with relatively manageable inventory pressures, positive industrial development trends should provide sustained support for real estate market recovery. Conversely, lower-tier cities facing significant inventory will encounter greater challenges in stabilizing their housing markets.”