Behind the long-term trend of the Indian stock market is the sustained and predictable trend growth in the profitability of listed companies in India.which is closely related to the long-term stable growth of the Indian economy.

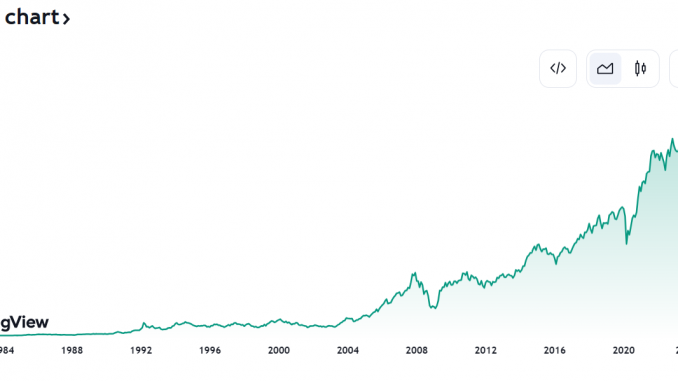

The Indian stock market had a long period of sideways volatility in the 1990s,and the Nifty50 index fluctuated between 800 and 1,400 points from 1992 to 2003.Since then, although the Nifty50 index has experienced bull and bear markets, it has experienced “small declines and sharp rises”, and has shown an overall upward trend.and hit a record high of 22,000 points in February 2024, which is nearly twelve times the point at the end of 2003, and the annual return rate is about 13%.

Strong economic growth is the root reason of the Indian stock market rally

GDP is the flow, wealth is the stock, and rapid economic growth is usually accompanied by the appreciation of local assets. For example, the long-term bullin of U.S. stocks since 2009 has been accompanied by the longest economic boom in the United States after World War II (except for the short recession due to the impact of the epidemic at the beginning of 2020), India’s stock market boom over the past two decades is also the product of high economic growth.

According to the statistics of the International Monetary Fund (IMF), the average growth rate of India’s real GDP from 2000 to 2022 is 6.5%,which is higher than the global average growth rate of 3.6% during the same period, and also higher than that of emerging markets and developing economies during the same period.According to statistics from the Indian Bureau of Statistics, India’s nominal GDP (current price of Indian rupee) grew at an average annual rate of 12.7% from 2003 to 2023, which is similar to the average annual growth rate of India’s Nifty50 index during the same period.

The profit levels of listed companies in India fluctuate with the pace of India’s economic growth, it directly impacting the trends of Indian stock market. Looking at the historical overall profit change, from 2004 to 2023, the average year-on-year growth rate of net profit per share of the Indian Nifty50 index is 14.6%, faster than the average growth rate of 12.5% for net profit per share of the MSCI Emerging Markets Index during the same period. In terms of the pace of profit change, the year-on-year growth trend of net profit per share of the Indian Nifty50 index generally shows a characteristic of a cycle of 3 to 5 years (the growth rate gradually increases from low to high, then it peaks and falls back), and the movement of the stock index also roughly follows the profit cycle changes.”

So which sectors in the stock market will rise first in 2024?

Barclays Capital Anand Gupta believes: “The financial and consumer sectors are expected to become the sectors that will push the Indian stock market to a new high in 2024. As the head of investment in India, I will lead my friends in Barclays Capital India to share this cake in the investment market. It aims to promote the economic up and share the benefits brought by the prosperous economy. This is my vision in 2024.